The Sunshine Millionaire: How one man took £130m from British taxpayers

He spent an Essex council’s money on a lifestyle few can dream of – and left the people who live there to pick up the bill

A rogue businessman appears to have cheated a council in Essex out of as much as £130m and spent the money on a life of luxury in potentially the largest fraud ever committed against a UK local authority.

Liam Kavanagh and his companies convinced Thurrock council to hand over the equivalent of almost its entire annual budget while inflating the value of a group of solar farms it had invested in, The Bureau of Investigative Journalism has found.

Never-before-seen financial records show the money was then spent on a country estate, private jet, luxury yacht and many other multimillion-pound purchases for Kavanagh, 46. He decked out one of his properties in gaudy crystals, drove a £2.3m Bugatti supercar and bought a million-dollar diamond-encrusted Hublot watch. The watch alone cost twice as much as the average house in Grays, the Essex town where Thurrock council is based.

In the middle of his spending spree Kavanagh ordered one of his directors to provide Thurrock with further exaggerated information to get his hands on £40m. Kavanagh told him it “won’t be a problem” if the council lost money.

Sean Clark, Thurrock’s chief financial officer, who arranged the payments in secret, ignored legal concerns with the proposed investment and transferred the £40m. That sum, along with the rest of the £130m, will almost certainly never be repaid.

Now the people of Thurrock, who unknowingly funded Kavanagh’s lifestyle, have been told their bankrupt council will have to hike taxes and cut services to the bone for years to come.

These findings, the culmination of a four-year investigation by TBIJ and broadcast with Panorama, have been described as “utterly damning” and there are calls for a police investigation. Andrew Jefferies, leader of Thurrock council, said he was “deeply sorry for the shocking and unacceptable failings of the past”.

Kavanagh denies ever misleading the council and strongly denied the allegation of fraud. He said his businesses were not responsible for the council’s investment decisions and that valuations go up and down. He asserted that the terms of the deals with the council meant his businesses were free to spend the money invested as they pleased.

‘Back of a fag packet’ valuation

On 21 November 2018 the council transferred £40m to Kavanagh’s company Rockfire Investment Finance.

When contacted as part of this investigation, APSE said Rockfire had provided data about the solar farms which was then inputted into the model used to value the sites. APSE said there had been no mistake with its own calculations. There is no evidence to suggest that APSE was aware that Rockfire had provided them with an unrepresentative pricing figure that would inflate the valuation. Kavanagh said his company had given accurate information to APSE.

Financial records seen by TBIJ show almost all of those funds immediately disappeared from the company’s accounts in three payments – the largest of which was £36.5m. That’s more than Thurrock spends each year on supporting children with special educational needs, gone within a day. TBIJ has not been able to trace that money.

‘He went incredibly fast into spend mode’

Within a few months Kavanagh was back for more. On 8 February 2019 the council transferred a further £50m to Rockfire Investment Finance – the second increase to its investment in the 32 solar farms.

A witness described Kavanagh leaving a meeting at the May Fair Hotel and boasting of having secured the staggering sum. “He came out and said he had just got £50m. I said ‘£50m?’ because I thought I had misheard. He said, ‘Yeah, they had just signed up [for] £50m’. He was chuckling when he said it.

“Something that stuck in my head was he was very happy, but very relaxed about it, almost as if it were a normal amount to him.”

Kavanagh would stay happy. Rockfire Investment Finance’s records clearly show Thurrock’s £50m being used to fund extravagant purchases for his own benefit.

A £294,000 outlay in June 2019 was labelled “deposit on villa” alongside Kavanagh’s initials. Later that month Rockfire Investment Finance’s records show £783,000 being spent on a McLaren Senna supercar. In October of that year there were five transactions totalling £2.3m for a Bugatti Chiron.

A source with knowledge of the purchases made during this period said: “The impression I got was that all of a sudden he couldn’t spend his money quickly enough, whether it was on cars or aircraft or other assets. He went incredibly fast into spend mode.”

Kavanagh’s lawyers, Carter-Ruck, have previously told TBIJ the additional money provided by Thurrock “could be legitimately used for any business purpose” and that any suggestion he had “personally received public funds that were intended as investments, which he spent on high-value assets” was “manifestly false”. The records of his own company show that to be far from the case.

When confronted before this story, Kavanagh’s position changed. He now argues the terms of the investments placed no restrictions on how the money could be spent and suggested others at the company bore responsibility.

Kavanagh claims the Instagram account was set up by a tattoo artist he knows without his knowledge or consent and that he had never put information relating to his private life in the public domain.

Eleanor Shakespeare for TBIJ

Eleanor Shakespeare for TBIJ

‘Wealth for years to come’

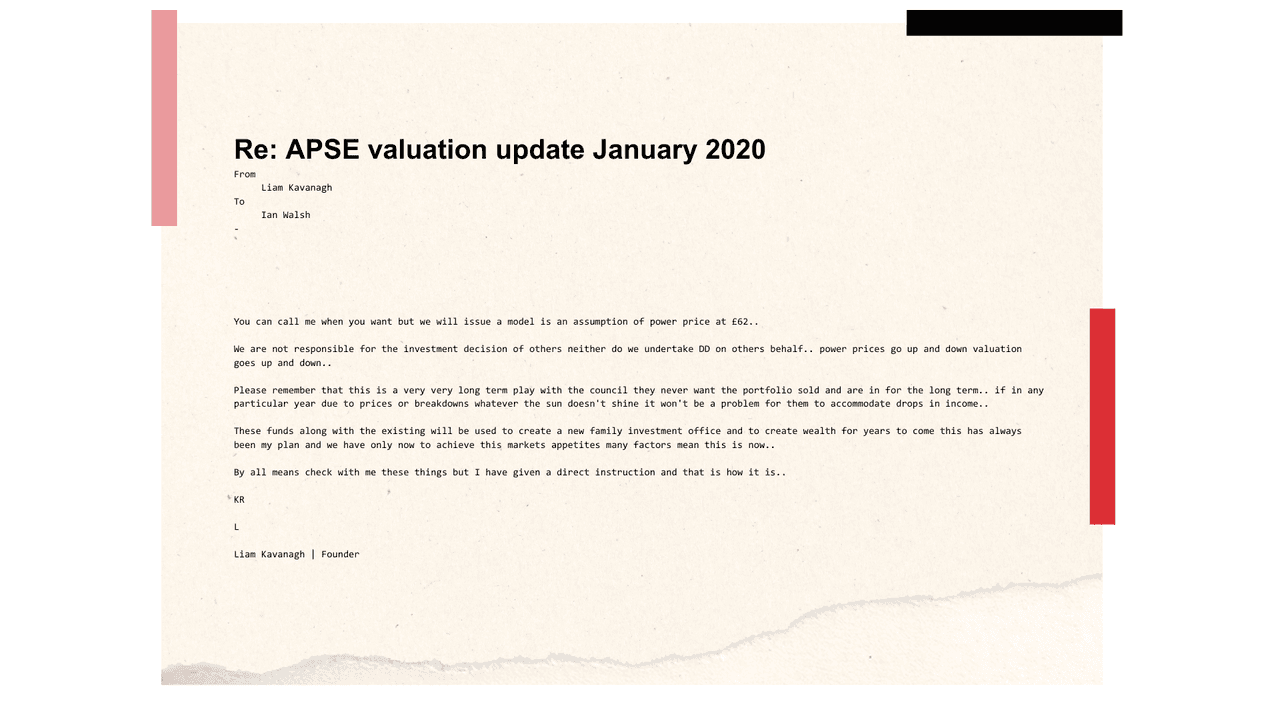

In January 2020 Kavanagh personally intervened to ensure Thurrock council handed over another £40m.

To achieve this level of investment Rockfire Capital needed to show the same 32 solar farms were worth even more of the taxpayers’ millions. However, using figures provided by Toucan Energy, the company managing the sites, would have resulted in a valuation nowhere near the value Kavanagh wanted.

And he knew it. “Just to make you aware on the proposed £40m - we have received this from Toucan,” read an email from Ian Walsh, finance director at Rockfire Capital, to Kavanagh.

The value of the farms depended on the predicted price the power they produced could be sold at, valued per megawatt-hour (MWh). Walsh explained the power price provided by Toucan was £41.70 per MWh, far less than the £62 Kavanagh wanted. This would have a “significant impact” on the valuation of the sites, he wrote, before adding: “Can we discuss in the morning please?”

Kavanagh’s reply was unequivocal.

“You can call me when you want but we will issue a model [with] an assumption of power price at £62,” he wrote. “We’re not responsible for the investment decision of others, neither do we undertake DD [due diligence] on others’ behalf.”

The deals with Thurrock were a “very long term play”, wrote Kavanagh, and it wouldn’t be a problem for the council to “accommodate drops in income” – an approach which Thurrock’s subsequent financial collapse has proved entirely false. As for himself, Kavanagh made the aim of this particular “play” – and all his deals with Thurrock – abundantly clear.

“These funds, along with the existing, will be used to create a new family investment office and to create wealth for years to come,” he wrote. “This has always been my plan and we have only now to achieve this.”

“By all means check with me,” he added, “but I have given a direct instruction and that is how it is.”

That instruction appears to be clear. Thurrock was to be provided with an inflated power price so Kavanagh could make as much money for himself as possible. This contributed to the taxpayer losing tens of millions of pounds, all for his own personal gain.

The misleading price – effectively the same as used in November 2018 – was provided on Kavanagh’s order to APSE. However, before Thurrock handed over yet another £40m, the law firm Bevan Brittan “flagged serious risks” about the transaction to Clark personally. He ignored those concerns and, on 27 January 2020, authorised the payment. While there is no suggestion he was aware of the inflated prices being presented to him or that his investments were being spent on luxury items, Clark has never explained why he went against the legal advice.

Kavanagh told TBIJ that the figure he told Walsh to use was an accurate representation of the future power price for the solar farms, which he claims has now been borne out by power price increases since. Walsh did not respond to TBIJ before this story was published.

‘Get rid of fucking Rockfire’

Exactly what happened to the final £40m is unclear. Rockfire Investment Finance’s records show it moving between accounts before being caught up in a company restructure that effectively hid how Thurrock’s money had been spent.

Kavanagh was already making significant changes to the running of his businesses before the last top-up arrived. Staff were informed of strict new spending limits and that their boss would only be in the UK for a few days a year. Information about his whereabouts was to be kept to a minimum, they were told.

In late January 2020 Kavanagh pulled out of an interview TBIJ had arranged with him as part of this investigation. Rockfire Capital’s website was later taken offline.

Then, following our first story in May 2020, Kavanagh was caught on a dash cam planning more drastic action. While being driven to an airport in Bournemouth to board his private jet, he spoke of the need to document things in order to “protect everybody’s interests and the money”.

He described how a “bomb got dropped” with the “fucking article shit” but that it had made up his mind to wind up Rockfire Investment Finance and start selling the solar farms. “I’m not bothered now,” he said, “I’m never going to raise a pound from a local authority again.”

After appearing to confirm that the process of deregistering his companies had started, Kavanagh said: “Get that gone. Get shit transferred over, get rid of fucking [Rockfire Investment Finance], get rid of all this other bullshit”.

And that is exactly what happened. Rockfire Capital, which marketed the investment opportunities to local authorities, was put into liquidation. A Kavanagh-owned company that acted as a security trustee for some of the deals with the council was dissolved. An application was submitted to wind up Rockfire Investment Finance despite the company owing Thurrock more than £500m. This meant accounts for 2019 and 2020, the years when the luxury purchases were made, have never been filed.

In December 2020 Kavanagh bought Ashe Park, a 232-acre country estate in Hampshire for £22m. The period property has six reception rooms, seven bedrooms and extensive grounds replete with a tennis court and stables. Like the other purchases, this too was funded by Thurrock’s money, with the deposit referenced explicitly in the records of Rockfire Investment Finance. The company’s records also show payments totalling tens of millions of pounds to Kavanagh personally throughout the period of his deals with the council.

The solar farms were eventually transferred to a new company, Toucan Energy Holdings 1, with Kavanagh being paid £3.3m for “advisory services” relating to the contrived restructure. He denies trying to hide anything from the council and previously told TBIJ the restructure was to “streamline” his businesses.

The plan unravels

Any hope that the restructuring would stop further questions about how Thurrock’s £130m had been spent ultimately failed. In July 2022, TBIJ published details about the additional investments and Kavanagh’s purchases. In response financial advisers wrote to local authorities and urged them to stop lending to Thurrock.

In November 2022, Toucan Energy Holdings 1 went bust owing Thurrock £655m plus interest. A buyer for all the sites is now being sought. A report published by the administrators shows the additional £130m ploughed into the 32 solar farms by the council will not be recouped.

Later that month Thurrock revealed the collapse of its investment policy had left it with a budget gap of nearly £500m – the second largest ever reported by a UK local authority. Business deals gone wrong made up most of the shortfall, the largest of which was the investment in Kavanagh’s solar farm empire. In the build-up to Christmas the council declared itself effectively bankrupt.

A government bailout of £635m will help the council to balance its books, but the repayments will place strain on its budget for at least 20 years.

‘Rapid reduction’ in services

Kavanagh spent Thurrock’s money on a lifestyle few can dream of. The people who live there will be picking up the bill for decades to come.

In March Thurrock was given special permission to impose a 10% council tax without a local referendum. Years of increases are likely to follow. The huge budget gap will also require widespread cuts, but residents have heard little about which services will be affected. A government-commissioned inspection report, published in June, said the council required “urgent change”.

“The scale of the financial challenge now facing the council means it is inevitable that, in addition to making extensive efficiency savings, the council will have to undertake a significant and rapid reduction in the scope of local services,” said the report.

The Bureau newsletter

Subscribe to the Bureau newsletter, and hear when our next story breaks.

“Many services, which have been relatively well funded over the past decade may, as a consequence, be equipped to do little more than the statutory minimum for the foreseeable future.”

John Kent, leader of the Labour group on Thurrock council, told TBIJ: “These new allegations are utterly damning.

“It looks like the council has been a victim of a colossal fraud and, as always, it’s the innocent residents that will be picking up the tab through sky high tax increases and vastly poorer services for decades.

“The question remains – what is the council going to do about it?”

‘It makes me angry they’re not stepping up’

The answer, so far, is not a lot. The government inspectors were heavily critical of Clark, who arranged all the investments and largely ignored the few limitations placed on him by councillors. He was supposed to tell party leaders about deals over £10m before they were made. He rarely did so. Crucially, he failed to disclose any of the additional investments that eventually led to the loss of £130m.

Inspectors said Clark was “central to the … failure of the council’s investment strategy”, lacked the “skills and experience to safely deliver” the policy and had not secured appropriate investment advice. They were unable to find any document that set out the information he considered before investments were made. As a result it was “impossible to know what risks were considered”, said the report. Councillors who were supposed to scrutinise what Clark was doing repeatedly failed to do so.

Eleanor Shakespeare for TBIJ

Eleanor Shakespeare for TBIJ

The council was waiting for the inspectors’ verdict before deciding whether to take action against any individuals. In June, the newly elected council leader, Andrew Jefferies, was asked whether his administration supported calls for a police investigation. He said the council was “committed to fully investigating all aspects of its finances” and that “all options will be considered”.

However, Essex Police has yet to open a criminal investigation, and the council has made no complaint to them. The Serious Fraud Office (SFO) would not confirm or deny whether an investigation was underway. The Insolvency Service started investigating the restructure of Kavanagh’s companies in July 2021 but declined to comment on its findings.

TBIJ shared its evidence with Gavin Cunningham, partner in forensic services at accountancy firm Menzies and a former senior investigator at the SFO. He believes the council was misled by the valuations produced on behalf of Rockfire Capital.

He added: “Since the subsequent use of the top up funds appears to have included acquiring assets which were or could have been for the personal benefit of Mr Kavanagh, that makes this particularly egregious and potentially fraudulent.

“Given the nature of the allegations and the very large sums of money involved, these events require investigation by an appropriate law enforcement body.”

The council is also yet to take civil legal action against anyone involved in its failed investments, although it is understood to be preparing cases. In the meantime Kavanagh has sold Ashe Park and his jet, and has been living in a luxury villa in Dubai.

Responding to TBIJ’s findings, Jefferies said: “As a council we recognise that things went very wrong and our focus is on taking the necessary action to put that right.

“I am deeply sorry for the shocking and unacceptable failings of the past. We are taking all appropriate action to recover the council’s financial position while ensuring that we protect vulnerable residents and essential services.”

The council’s inaction and its refusal to say whether it has been the victim of a crime, be that fraud or misconduct in public office, have deterred people with knowledge of the events from speaking out for fear of being sued by Kavanagh. Last year he took legal action against one of TBIJ’s sources. Some agreed to speak on condition of anonymity. Others felt unable to help at all.

One source told TBIJ: “Thurrock have never made any statements that they believe they are a victim of anything. Having seen the valuation and emails, it makes me angry they’re not stepping up and saying they’re a victim. It makes me angry that Clark is allowed to maintain silence as to what he thought the £130m was for.”

In response to our investigation, Liam Kavanagh released the following statement through his lawyers.

He said: “Thurrock council’s recently published Best Value Inspection Report publicises that Thurrock council had, since 2017, built up a very substantial portfolio of investments without any member or executive oversight. Various of those investments in companies completely unconnected to me caused Thurrock council significant losses. The report makes clear that internal checks and balances were not in place that should have been.

“I was approached by Thurrock council in relation to investments in solar farms and those investments produced significant income for Thurrock council over a number of years and the assets continue to make a profit; even more so with recent rises in energy prices.

“I have never misled Thurrock council during the course of those investments. It was always my understanding that Thurrock council conducted its own independent due diligence into investments. I have had a successful career over the course of decades, preceding and outside of renewable energy, and separate to any of the Thurrock council investments.”

Make change possible

Investigative journalism is vital for democracy. Help us to expose injustice and spark change

Click here to support usHeader illustration by Eleanor Shakespeare

Reporter: Gareth Davies

Data work: Charles Boutaud

Impact team: Miriam Wells, Lucy Nash, Rachel Hamada

Deputy editor: Chrissie Giles

Editor: Franz Wild

Production editor: Frankie Goodway

Fact checker: Alice Milliken

Legal team: RPC

Illustrations: Eleanor Shakespeare and

Visual design by Buried Signals Studio

Our reporting on local power is part of our Bureau Local project, which has many funders. None of our funders have any influence over our editorial decisions or output.

-

Area:

-

Subject: