Harvard climate professor lobbied regulator on behalf of oil giant

The Harvard environmental law professor at the centre of a conflict-of-interests row lobbied the US regulator on behalf of a giant oil and gas company, a new investigation can reveal.

Emails seen by TBIJ and the Guardian show that Jody Freeman helped arrange a meeting between a director at the Securities and Exchange Commission (SEC) and ConocoPhillips, a hugely polluting company that has tried to weaken forthcoming climate regulations.

Freeman, who receives more than $350,000 a year from ConocoPhillips as a board member, used her Ivy League connections to vouch for two of the oil firm’s executives and appears to have breached Harvard policy by failing to disclose her role with the company in her email, which she signed off as a Harvard law professor.

Freeman told TBIJ that the request for a meeting with ConocoPhillips executives came from a colleague who was an SEC director at the time, and that her actions were compliant with Harvard’s conflict-of-interests policies.

The disclosure of the emails comes after revelations by the Guardian that Freeman won a grant to research corporate climate pledges and amid growing debate about the influence of the fossil fuel industry on US university campuses.

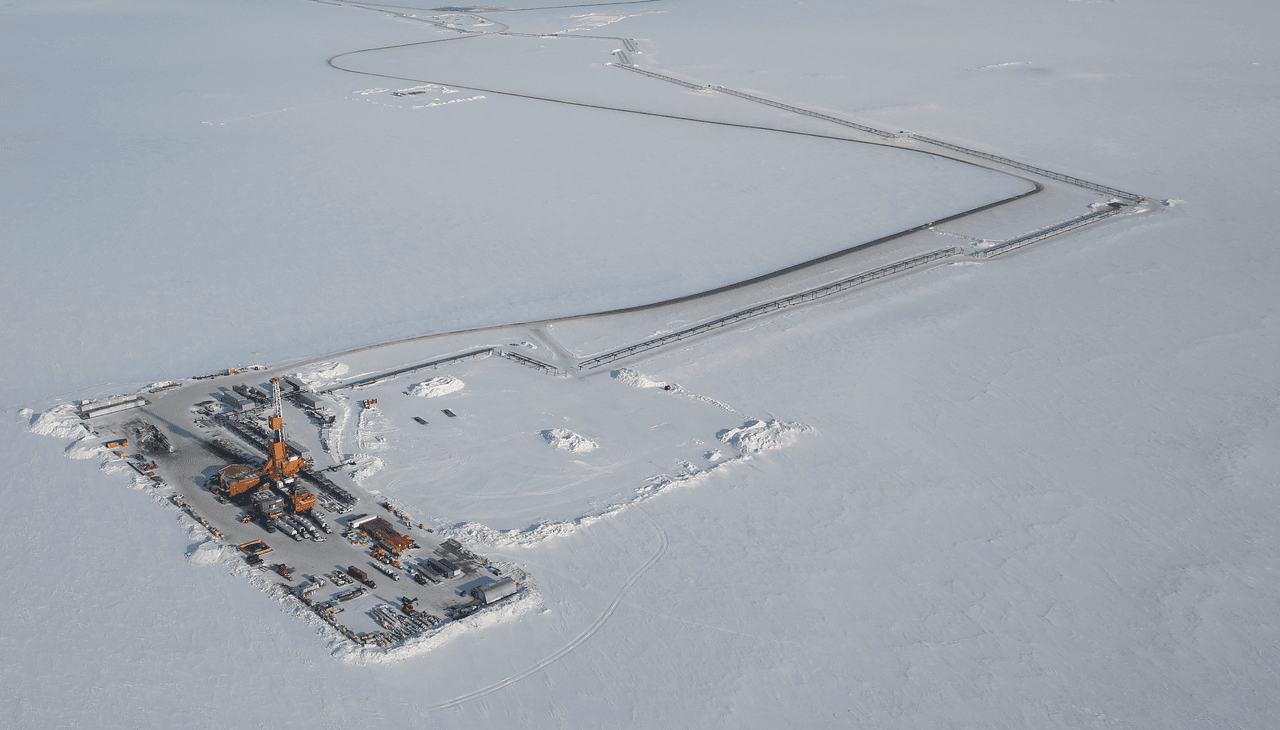

This week, ConocoPhillips won an Alaska federal court ruling to proceed with a highly controversial oil project to drill for 600 million barrels on pristine land in the state. Environmentalists had called for a halt to the development owing to its impact on Indigenous communities and biodiversity.

Freeman is a respected name in sustainability having served as an energy and climate advisor to the teams of presidents Obama and Biden.

The SEC is proposing rules that would require companies to publish their direct and indirect emissions. Freeman’s emails – sent in January 2021 and obtained via a Freedom of Information Act request – show she helped set up a meeting where ConocoPhillips executives could set out their position in private before the regulator publicly requested input from investors and companies. The company has since sent its official response to the SEC, opposing the rules.

In her email to an acting director at the SEC, Freeman wrote effusively about Dominic Macklon, a ConocoPhillips executive, and Lloyd Visser, its head of sustainability.

“I can tell you from personal experience that these are the right people to help with this exercise,” Freeman wrote. “They are hugely knowledgeable, thoughtful, and interested in solving problems – I can promise that you will get high value from this engagement.”

She went on: “ConocoPhillips is widely recognized as the oil and gas industry leader on climate related disclosure ... Lloyd himself is highly influential on these issues … and both he and Dominic – as the senior executive in the company with responsibility for this brief – are intimately aware of the financial sector's interest in these issues.”

Freeman also said that Visser chaired the climate committee at the American Petroleum Institute (API), an influential lobby group. Having proposed an initial meeting with the SEC that she would attend herself, she said “a couple of briefings would be well worth the time”.

Freeman told TBIJ that John Coates, a Harvard colleague and an acting SEC director at the time, knew of her relationship with ConocoPhillips, which was “common knowledge in the community”. She said Coates had asked her for contacts at the firm. Coates supported her account.

She added: “My role as an independent director on the board of ConocoPhillips is about helping advance the transition to a low-carbon economy.”

ConocoPhillips, Harvard and the SEC had not responded to TBIJ’s requests for comment by the time of publication.

‘We must act now’

Harvard has presented itself as a leader on sustainability and has promised not to use its $39bn endowment to make any direct investments in companies that explore or further develop fossil fuel reserves.

Freeman plays a significant role in the university’s response to climate change, having founded Harvard’s environmental and energy law program, and as co-chair of its sustainability committee.

Fossil Fuel Divest Harvard, a student campaign group, wrote to Freeman after the White House’s decision on the Alaska oil project, urging her to leave the company’s board. “It is important to ask yourself … if ConocoPhillips [is] … co-opting the respect and legitimacy accorded to someone of your position,” the students wrote.

Freeman’s emails with the SEC also appear to contravene Harvard policy, which states: “Faculty members must make public disclosures of financial interests in related outside entities.”

A separate policy says Harvard members “should otherwise aim to make clear that they are acting as individuals and not on behalf of the University” when pursuing outside activities.

As a board member, Freeman has a responsibility to act in the financial interest of ConocoPhillips. Her remuneration from the company is a combination of cash and stock awards.

ConocoPhillips continues to explore and further develop fossil fuel reserves and extracted more than 600 million barrels of oil equivalent last year, which when burned would generate more than the annual emissions of Spain.

Kelly Mitchell, an oil and gas analyst at the research organisation Documented, said: “It undermines Harvard's climate ambitions if a faculty sustainability leader is using the university's prestige to run cover for an oil company's greenwashing efforts.”

New rules

The SEC put forward its proposed climate disclosure rules last year, which included requirements for companies to publish their direct and indirect emissions, and the risk posed to their business by climate change.

The final rules are expected in the coming months but could still be subject to a legal challenge. West Virginia Attorney General Patrick Morrisey has threatened to sue if the SEC requires companies to report on greenhouse gas emissions.

Reports show oil and gas companies have stepped up lobbying efforts in an attempt to dilute the proposed rules.

Ben Cushing, campaign director at the Sierra Club, said the fossil fuel industry “appears to be advocating for a weakening or outright killing of this SEC disclosure rule in a way that would benefit big oil companies’ agenda to hide the extent of their pollution and climate risks”.

The majority of investors, however, are in favour, according to an analysis by Harvard Law School.

Steven Rothstein, managing director at Ceres, a non-profit focused on climate and finance, said: “Climate is a material financial risk to companies. The SEC was established to ensure that investors have enough information so that we have a robust capital market. Investors overwhelmingly are saying they need more information.”

Lead image: Harvard Law School. Credit: Robin Utrecht/Sipa USA

Reporter: Josephine Moulds and Nina Lakhani

Environment editor: Robert Soutar

Impact producer: Grace Murray

Global editor: James Ball

Editor: Meirion Jones

Production editors: Alex Hess

Fact checker: Alice Milliken

This reporting is funded by The Sunrise Project. None of our funders have any influence over the Bureau’s editorial decisions or output.

-

Area:

-

Subject: