Spelthorne spending spree 'likely broke the law'

A council has been accused of likely breaking the law and could be taken to court by its own auditors after borrowing £1bn in public money to invest in commercial property, according to explosive letters seen by the Bureau.

In the letters KPMG, one of the “Big Four” accounting firms, sets out why it has spent two years refusing to sign off the accounts of Spelthorne borough council, a tiny local authority in Surrey that spent £1bn of public money on office blocks.

The auditor says its legal advice found it was likely that the purchase of three office buildings for £239m in 2017-18 was unlawful because Spelthorne ignored rules that forbid councils borrowing purely to make a profit on subsequent investments. KPMG warns it could take the unprecedented step of going to court to seek a ruling that the council has broken the law.

If the court agreed, it would not only call into question the entirety of Spelthorne’s £1bn investment portfolio but potentially have serious implications for dozens of other local authorities that have also borrowed heavily to fund property purchases, as well as other money-spinning investments.

Spelthorne’s spending, funded entirely by borrowing from the public purse, is the most high profile example of cash-strapped local authorities buying property in the hope that rental income can replace money lost to government cuts. In 2018-19 councils across England and Wales spent £6.6bn on acquiring offices and shopping centres – more than ten times the amount spent in the previous three years.

However, the coronavirus crash and subsequent wide-scale plans to permanently switch from office to home working means much of that investment could be at risk, as the value of commercial property slumps.

Earlier this year an inquiry by the Public Accounts Committee into local authority property investments, prompted in part by a series of Bureau investigations, accused the government of being asleep at the wheel while councils ignored the rules and borrowed disproportionately to fund spending sprees. The Treasury said it would ban councils from making such investments, but has yet to follow through on the threat.

It is unclear exactly what would happen if a judge were to rule against Spelthorne because an auditor has never taken such a “nuclear option” before. However, a senior figure within the council said they were “extremely concerned” that it could bankrupt the authority.

In their opinion: “Supposing the council has to sell the properties and repay the Public Works Loan Board. The cost of repayment is massive – someone told me it’s as much as 30% on top of what we borrowed. And then you’re trying to sell properties into a Covid-related commercial market. It would bankrupt the council. There’s no doubt about it.”

A spokeswoman for Spelthorne council said this was “wild speculation,” although the Treasury confirmed to the Bureau that there would be a penalty fee if the council had to repay its loans early.

The council has always insisted its purchases followed extensive advice and due diligence. But the KPMG letters demonstrate that the council has been unable to assuage serious concerns from its own auditor that the spending spree was likely unlawful and should never have been allowed to happen.

Delays and denials

Under normal circumstances, a council’s 2017-18 accounts would have been audited and signed off two years ago. Spelthorne council’s financial records for that year, however, are still awaiting approval. The two letters leaked to the Bureau make clear this is because of grave concerns KPMG holds about a series of property investments.

Between July 2017 and January 2018, Spelthorne spent £239m on three office buildings, including £171m on 12 Hammersmith Grove in London - the second most expensive purchase in its portfolio. The acquisitions were funded by borrowing from the Public Works Loan Board (PWLB), a government lending body that councils traditionally use to finance things like new schools and other civic projects.

The Bureau first reported on Spelthorne's borrowing and investment strategy in 2018

The Bureau first reported on Spelthorne's borrowing and investment strategy in 2018

In the first letter to Terry Collier, the council’s chief finance officer, in October 2019, KPMG says it has taken legal advice that suggests the council ought to explain how it followed various regulations and guidelines; specifically, rules that say local authorities “must not borrow more than or in advance of needs purely in order to profit from the investment of the extra sum borrowed”.

KPMG also asked for evidence that the council had considered whether the amount of money it was borrowing – which dwarfed its annual spending on services – was proportionate. The auditors wanted to see any legal advice the council had taken on its borrowing and investment decisions, while noting the council had spent another £290m, on similar properties on exactly the same terms, in 2018-2019.

A second letter to Mr Collier, dated August 13 of this year, makes it clear KPMG’s concerns had not been addressed. “While your letter was helpful,” a KPMG director wrote, “it did not provide us with the reassurance required for us to conclude that no further action is appropriate.”

As a result KPMG was considering taking formal action, including asking a court to state the council had breached its statutory duty. While legislation gave auditors this power in 2014, it has never been used against any council in the UK.

Sati Buttar, the council’s cabinet member for finance, told the Bureau: “This is still an on-going matter between the council and KPMG and no conclusions have been reached by either side. However this council has taken all necessary steps to ensure that it abides by the law in all its actions and we absolutely refute any suggestion that the Council has acted unlawfully. Our legal advice sets out clearly we have strong legal grounds to support our approach.”

Checkered history

This is not the first time KPMG has voiced substantial misgivings about Spelthorne’s investments.

In April 2019, the Bureau revealed that the auditor had delivered a damning assessment of the council’s £385m purchase of a BP research centre in Sunbury – the most expensive property investment ever made by a local authority. Again it followed an extended period where KPMG had refused to sign off the council’s accounts.

The auditor highlighted “significant weaknesses” relating to the purchase, describing the decision-making process – conducted via email – as “generally poor and difficult to follow”. It also questioned whether risks had been properly considered before the building was bought under delegated authority, a process that allows council officers to sign off deals without public or councillors’ scrutiny.

The auditor concluded: “We are not satisfied that, in all respects, Spelthorne borough council put in place proper arrangements to secure economy, efficiency and effectiveness in its use of resources.”

In response, the council defended its processes and insisted it had sought “appropriate professional advice from a range of best in class advisers who provided exhaustive due diligence and ensured that risks were identified, discussed and mitigated”.

The BP research centre in Sunbury bought by Spelthorne

The BP research centre in Sunbury bought by Spelthorne

Spelthorne was fully aware KPMG suspected its investments may be unlawful when the council publicly criticised the auditor in July 2020. The council told the Public Accounts Committee inquiry into local authority property investments that it was “extremely disappointed by the speed and lack of engagement of KPMG” relating to the 2017-18 accounts, even though the letters obtained by the Bureau show the auditor had made its serious concerns apparent in October 2019.

The council then went further by questioning KPMG's understanding of the “complex and sensitive issues” and suggested concerns about the accounts related to “immaterial matters”.

A council spokeswoman told the Bureau: “We do not agree that the council’s statements made to the Public Accounts Committee were misleading.”

While KPMG worked on Spelthorne’s 2017-18 accounts, the council has decided to replace the company as its auditor with BDO.

Coincidentally, BDO rents office space in Thames Tower in Reading, which Spelthorne bought in September 2018 for £285m alongside two other office blocks in the region – purchases that BDO was then supposed to assess as part of the council’s 2018-19 audit. In a letter to the authority, BDO said it had concluded there was no conflict of interest in the council being its landlord.

The council’s 2018-19 accounts are yet to be signed off.

Looming crisis

The revelation that Spelthorne’s landmark policy may be unlawful could not have come at a worse time for the council.

In June Ian Harvey, the self-styled “visionary” and driving force behind the investments, was deposed as council leader, amid growing concern within the Conservative group about the purchases. He formed a splinter group and the Tories lost overall control of the council.

John Boughtflower, new leader of the Conservative group, pledged to launch an investigation into the investment programme, adding that he intended to introduce a spending limit so that “no single person will ever again have authority to spend tens of millions of pounds without the scrutiny that residents expect and deserve”.

The coronavirus pandemic has also devastated the office and retail market, forcing the council to make almost half of its reserves available to meet the costs of handling the crisis.

The Office for Budget Responsibility has predicted that the price of offices and commercial buildings will fall by nearly 14% this year. If accurate, that would reduce the value of Spelthorne’s portfolio by £140m.

We have more stories like this and we need your help to get them out there

To build a fairer, more democratic society, we all need to know what isn’t working and who is responsible. Our investigations expose wrongdoing to hold those with power to account and drive change.

Yes! I will support the BureauThe crisis has upset hopes that rental income could help fund services, as commercial clients have sought deferrals and rent holidays. The Bureau revealed that Spelthorne had secretly granted an 18-month rent free period to WeWork, the property management company that rents the Hammersmith Grove offices. The decision amounts to a £4.5m loss over the short-term in exchange for a five-year extension to the company’s 20-year lease.

The council told the Bureau that it had successfully collected more than 96% of the commercial rent due for the first six months of the financial year.

The decision to grant the deferral, and several others, was taken behind closed doors by a special investment committee that had three voting members. The recent upheaval at the council has brought more light to these decisions, as well as long-standing concerns over delays in signing off the 2017-18 accounts.

However, the Bureau understands that despite calls for a public council meeting to discuss KPMG’s concerns, councillors will instead be provided with a confidential briefing by council officers next Monday.

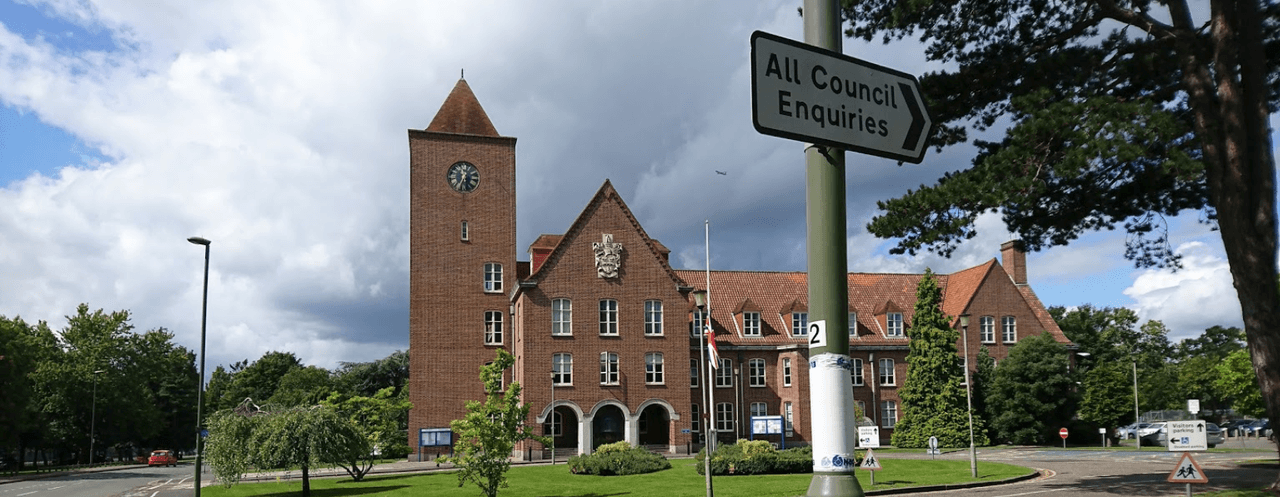

Header image: Spelthorne borough council

Our reporting on local power is part of our Bureau Local project, which has many funders. None of our funders have any influence over the Bureau’s editorial decisions or output.

-

Area:

-

Subject: