Has Peterborough Council unlawfully used money raised from selling public spaces?

The government is investigating whether Peterborough Council may have broken the law by selling public spaces to help meet its running costs, in response to findings by the Bureau of Investigative Journalism.

As part of a major investigation revealing the mass sell-off of public property by cash-strapped councils, published on Monday in partnership with HuffPost UK, we have discovered that Peterborough Council appears to have used nearly £23 million from selling property to help balance its books for the past four years. While councils are allowed to use money from selling property for certain purposes, they are not allowed to use it simply to plug holes in their budgets.

Of immediate concern are the council’s plans for the coming financial year which are due to be approved by councillors at a meeting tomorrow. At the moment the proposed budget is reliant on using another £10.6 million of money made from selling assets just to break even.

If found to be in breach of the rules, the planned spending could be disallowed and the Conservative-led council, which serves a population of almost 200,000, would have to find another way of bridging the gap as a matter of urgency.

There are fears Peterborough could follow the same path as its neighbour Northamptonshire, which last February became the first council in nearly 20 years to ban all but essential expenditure after it effectively ran out of money. A government investigation found Northamptonshire council had breached regulations by selling off assets to balance its books in the years leading to its financial collapse.

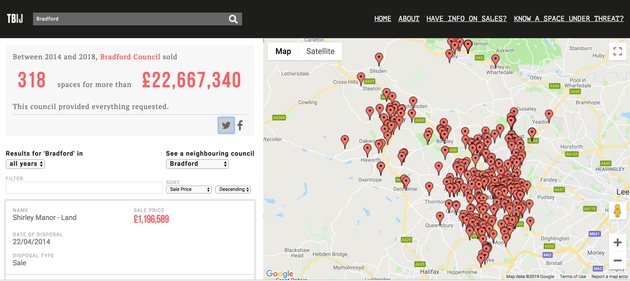

Sold From Under You, our project investigating council sell-offs, has revealed details of more than 12,000 public buildings and spaces including libraries, youth clubs and day centres sold since 2014/15. Councils have raised £9.1 billion from selling property during this period.

The money raised from selling assets is called “capital receipts.” Councils are allowed to use this money either to buy new property or to pay the upfront costs of reforms that will generate “ongoing savings,” such as merging offices or investing in new technology. Our investigation found many councils have used capital receipts to pay for redundancies (making people redundant costs money as councils need to provide pay-offs).

Statutory guidelines forbid councils from spending the proceeds raised from selling public spaces just to meet their running costs. The rules are designed to protect public spaces by preventing councils from becoming reliant on selling them off in order to break even.

Our analysis of Peterborough Council’s finances suggests it has used £23 million this way. It has sold fifty building and land assets - such as pubs, petrol stations, a former community college and farmland - since 2014/15. The council acknowledges it has used capital receipts to meet running costs, but argues the way it has done so is legal.

A report last month revealed the council has earmarked a further 27 sites for sale over the next two years, including Peterborough United’s football ground, a bowling green, allotments, a library and a car park, with an additional 13 described as under consideration. “The best way to describe it is a fire sale,” Labour and Cooperative councillor Ed Murphy told the Bureau.

Shaz Nawaz, leader of the opposition Labour group on Peterborough Council, said the revelations were very disturbing. “I’m extremely concerned that this administration has not kept a better control of the situation,” he said. “It shows their clear lack of competence.”

The council was showing a seeming disregard for the statutory guidelines, he said. “Today’s revelations are beyond shocking. I’m afraid what this will lead to.”

Peterborough Council cabinet member for resources David Seaton denied there was anything unlawful about the proposed budget: “We are not acting illegally in taking this approach,” he said. “It has also been confirmed as appropriate by both external Treasury advisors and the council’s own external auditors.”

We passed our analysis of Peterborough’s finances and the council’s response to our questions to the Ministry of Housing, Communities and Local Government, which told us: “We are examining Peterborough Council’s use of capital receipts in the light of this information. Local authorities must demonstrate the highest standards of transparency and accountability, and where appropriate, the Government will take action where this is found not to be the case.”

Local Government Minister Rishi Sunak told the Bureau that while rules on the sale of council assets had been relaxed three years ago, “we are clear that this does not allow for assets to be sold for authorities to meet day-to-day revenue costs.”

What has your council sold? Enter your postcode into our interactive map to find out.

Peterborough’s accounts and other financial reports suggest that over the last three financial years the council used nearly £23 million raised from selling property in two ways which could potentially be unlawful. Firstly, it has used the money to pay parts of its running costs - for instance this financial year there was an overspend in social care which seems to have been paid for with proceeds from asset sales. Secondly, it has used money generated from selling public spaces to pay the annual cost of its debt - a payment which is technically known as Minimum Revenue Provision (MRP).

MRP is an amount a council has to pay each year against whatever debt it has - similar to a monthly mortgage repayment. When councils make money by selling assets, they are allowed to use that money to make one-off payments that lower the size of their debt overall - but they are not allowed to use it to make the annual repayments.

The rules prevent the sale of public buildings and space simply to balance the books as this is not sustainable - if councils are reliant on selling assets to meet their annual repayments then once those assets are all gone they will have no way of paying their debts. Local authorities are required by law to work within budgets that use income they can rely on year in year out.

As such local authorities are not allowed to use capital receipts to pay MRP.

Peterborough’s accounts last year stated the council had become dependent on income from selling property - it was “reliant on maximising the revenue benefit of capital receipts,” said the document. Another £10.6 million of capital receipts is incorporated into planned day-to-day spending for 2019/20.

However, its latest financial report makes clear the policy of selling assets to make ends meet is unsustainable.

“As the council has used capital receipts from the sale of properties (assets) to support the budget for a number of years, the remaining value of assets is relatively low, especially with some of the higher value assets being sold in recent years,” the report said.

“This now leaves the council with very little flexibility to use capital receipts in the future to support the budget, and also reduces the potential for the council to generate property rental income.”

A council report from as recently as February 25 seems to indicate money from the sale of assets being used not just to repay debt but also as a lump sum to plug funding gaps in this year’s budget.

In exceptional circumstances the government can allow individual councils to use capital receipts to fund running costs but the ministry and the council confirmed to the Bureau that Peterborough has not been given any such permission in the last four years.

Although Peterborough Council’s own financial plans suggest that the sale of assets is being used to support the budget (which would be unlawful) in their response to us the council argued that the money was being used to pay off loans and was therefore technically legal.

Peterborough cabinet member David Seaton told the Bureau that the council had been forced into this position to try to protect the council services provided to residents: “We have always been clear that this approach is not a sustainable financial strategy, but one which has enabled us to adopt a strategic approach to tackling the budget gap at a time when we are facing the most severe cuts to government funding in the council’s history,” he said.

Relying on the sale of land and buildings to balance the books was one of the key reasons for the collapse in February last year of Northamptonshire County Council, which became the first local authority in almost 20 years to go effectively bankrupt.

As a result it was taken over by government-appointed commissioners and had to make “radical” cuts including to children’s services, road maintenance and waste management. It was also banned from using capital receipts to support its day-to-day costs, a decision which was reversed in November amid fears it would again be unable to set a balanced budget.

The revelations are part of a wider investigation by The Bureau of Investigative Journalism, in partnership with HuffPost UK, into the sale of publicly-owned buildings and land by local authorities in England.

Like all local authorities, Peterborough has lost a significant part of its funding from central government due to the austerity agenda. The amount given by government to councils has been cut by about 60% in real terms since 2010 and by 2020 councils are supposed to be entirely self-financing.

Last year Peterborough Council, which has an annual budget of £147.5 million, launched a Stand Up For Peterborough campaign to lobby the government for “fairer” funding.

All illustrations by Hannah Eachus

Our reporting on local power is part of our Bureau Local project which has many funders. None of our funders have any influence over the Bureau’s editorial decisions or output.