How Brits lose millions to UK’s biggest scam while government stands by

Thousands of British people have lost millions of pounds to an international scheme that is sold as an investment opportunity but in reality is a gamble or straight-up scam. While other countries have banned this business, a regulatory loophole has left UK victims completely unprotected – despite police saying it is now the biggest fraud in Britain.

The sale of what are known as binary options involves betting on whether financial assets, such as shares, currencies or commodities, will rise or fall over a specific time period. Even when the bets are legitimately placed, it’s a hugely risky enterprise – but our investigation indicates that for many companies binary options act primarily as a vehicle for scamming people out of money.

Victims are targeted by salespeople in call centres abroad – typically located in Israel and Romania – who use high-pressure tactics to convince them to invest. They are then led to believe that their investment is growing as bets are placed – but when they try to cash in their purported returns they are unable to.

The Bureau spoke to dozens of people across the UK who had been targeted by a range of different companies. Many people have had money taken off their credit cards without consent – in some cases thousands of pounds.

Hundreds of binary options companies exist around the world, making billions of pounds a year. A whistleblower working in Israel told the Bureau everyone in his call centre was aware that they were operating a fraud, and that salesmen were urged by bosses to “rape the clients” financially.

Software is used which allows clients to check their purported account activity online, showing their funds rising and falling as the bets are supposedly made.

How the con artists escape the law

The fraudulent sale of binary options is now the biggest scam in the UK, according to the National Fraud Intelligence Bureau’s deputy director and financial crime specialist, DCI Andy Fyfe. An average of two reports are made to police each day and the average investor loses £20,000.

This was likely just the “the tip of the iceberg”, said Fyfe, as most people would not bother reporting in the knowledge there was little police could do. There have been no successful prosecutions because the fraudsters are usually located abroad.

The business is not overseen by the Financial Conduct Authority (FCA) because it is classed as gambling. But the Gambling Commission only regulates operators that have equipment based in Great Britain.

Many binary options firms operating globally are completely unregulated. Others register themselves in Cyprus, where the central bank allows financial companies from other countries to apply for operating licences, and where the trading is classed as investment rather than gambling.

The firms can then operate anywhere in the European Union (EU), except where individual countries have introduced restrictions.

The Bureau has seen internal documents from some of the companies listing the names of hundreds of UK victims and how much they have lost. One British investor put in £200,000 and many others had lost tens of thousands. Typically people invest small sums to start with and are then drawn in with a series of false promises.

“George” originally put £250 into an account run by a binary options company called Inside Option. He was persuaded that if he put another £500 in, he would be insured against any losses. The only condition was he would have to wait eight months before taking out the money.

Inside Option sent him a letter guaranteeing that this would be the case on headed notepaper with a London address. All the payments were made on a credit card and George thought that meant he would be protected if it turned out to be a fraud.

He watched the trades taking place on his Inside Option electronic account and it appeared that the more money he put in the better he did. It was doing so well he persuaded his girlfriend and his mother to invest their savings too, influenced by salespeople who “incessantly pestered” him with offers of better and better terms.

Eventually after eight months they had invested £80,000 in binary options. According to the account their balance was now £500,000, but when George started trying to withdraw the money last year he ran into problems.

He was told the trader who had set up the account had left to look after his sick mother. Then Inside Option said it would have to bring in its legal department to check the validity of the deal, and after that he struggled to get hold of them. “The trail went cold,” George said.

He has so far failed to get the money returned on his credit card.

Hidden terms and conditions

“David”, a retired bus driver from north London, has been targeted so often he has had to change his number five times in the last two years. He lost so much money on scams that he became even more vulnerable to new ones as he was desperate to make back his losses.

He says Inside Option took £1,000 off his card without his permission and locked him out of his account. “I nearly cried,” he told the Bureau. “My wife was going to leave me.

Another victim’s account was credited with huge sums in “bonuses”, but he later discovered that under the company’s “small print” he could not now withdraw his funds. Inside Option’s terms and conditions – alongside those of many other firms – say that once a bonus has been credited, the account holder cannot withdraw funds before a minimum trading volume has been reached. The minimum volume is 25 times the bonus amount plus the deposit, which in this case came to more than £1 million.

“Richard” from Coventry was another Inside Option target. He was persuaded to hand over £14,000, some of which he had taken out of his pension under changes to the law brought in last year allowing people to withdraw money from their retirement funds.

The Bureau spoke to many other people who said they had been defrauded by Inside Option, as well as dozens of similar companies. Steve Taylor and Kim Innes (see box) were targeted by a firm called AA Option, which has been investigated by City of London police. The police declined to comment on the outcome of the investigation.

Most victims did not want their names published, in part because they feared being targeted by new scams.

Gold Lamborghinis and Ferraris

The targets are typically older investors frustrated by zero interest rates, looking for a better place to put their money. They are told that binary options are a conservative investment strategy. Some are persuaded to take advantage of the Government’s recent change in the law and cash in part of their pension.

“People have been persuaded to cash in some of their pensions and invest in rubbish,” Fyfe told the Bureau.

At the same time the fraudsters also target younger investors, drawn in by pictures circulating on social media of happy binary options investors with gold Lamborghinis and Ferraris, with fake profiles bolstered by purchased followers. Nearly a third of the people who go to the police are in their twenties.

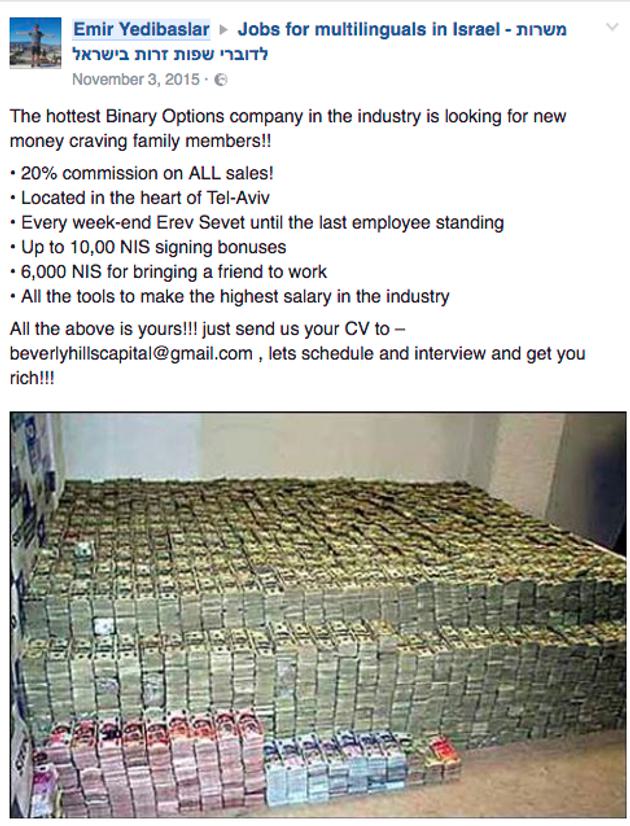

A Facebook post aiming to recruit new binary options salespeople

A Facebook post aiming to recruit new binary options salespeople

The web of binary options companies around the world is in a constant state of flux. As soon as there are too many complaints about one firm it is closed down and replaced by another.

Even the larger and more legitimate operators in the sector have run into trouble. The US bars binary options firms from selling to consumers unless they are operating through registered exchanges and contract markets, of which only a handful of companies are.

Earlier this year Banc de Binary, which describes itself as the world’s leading binary options trader, had to pay $11 million in restitution and fines for selling to American consumers.

The company, which says it has more than 250,000 customers in more than 80 countries, has also been fined this year by its regulators in Cyprus. But in Britain Banc de Binary has a high profile, sponsoring Liverpool Football Club for the last two years before this month switching to Southampton FC.

Following queries from media organisations including the Bureau, Southampton FC ended its partnership with Banc de Binary last week.

Belgium brought in a ban on binary option companies targeting consumers last month, and France is also considering introducing an advertising ban. Israel bans the sale of binary options to its own citizens but there is no law stopping them targeting foreigners.

Adopting British identities

The UK, on the other hand, has failed to take action, which has given traders a helping hand. Many fraudulent companies adopt British identities to inspire trust in consumers, said Fyfe, using “professional enablers” – formation agents, accountants, virtual office services – to incorporate companies in the UK. Some of these firms may be used for payment processing while others are “shell companies” with no purpose other than to provide a veneer of respectability.

Other binary options companies falsely claim on their websites to be regulated in Britain.

Last year the insurance market Lloyds of London had to issue a warning that AA Option was falsely claiming to be insured by the institution, meaning depositors were covered for any losses they incurred. No such insurance existed. The Bureau learned of dozens of investors who are now trying to get their money back.

Even grander claims have been made by other companies. Inside Option told one client the company was based in the famous Gherkin building in the City of London. It has also falsely claimed to be regulated by the British authorities, according to victims we spoke to.

One client which Inside Option told it was based in the Gherkin was even sent a copy of a fake lease agreement for office space in the building.

In an inconspicuous part of its website, Inside Option states it is owned by “The Masters Association”, a company based in St Vincent and the Grenadines. It was previously registered in Anguilla, where last year the regulatory authorities issued a warning to the public stating the company was not licensed to trade in binary options.

But the Bureau has discovered Inside Option is actually operating from a call centre in Israel.

The wolves of Tel Aviv’s Wall Street

Last spring a young Englishman posted an Instagram video of himself singing and larking around in an office in the Electra tower, a 45-storey block in the heart of Tel Aviv. The man, Jonathan Baker, was born and raised in Birmingham before moving to Israel some seven years ago.

Baker’s LinkedIn profile says he works as a sales co-ordinator for Express Target Marketing. The Bureau has seen multiple pieces of evidence indicating Inside Option is closely linked to Express Target Marketing, operating from the same office.

InsideOption.com and ExpressTargetMarketing.com’s domains are both registered to Emir Yedibaslar, a Turkish businessman whose Facebook profile at one point featured a photograph of Leonardo de Caprio proudly holding a $100 banknote in the movie “The Wolf of Wall Street”.

His Facebook posts show how he tempted people into the business: around the time Inside Option started trading in autumn 2014, Yedibaslar was advertising for “money craving foreign language speakers for his “start up” binary options company with the promise of “tons of cash”.

“Do you want to make a lot of money every month while having mad fun in the office??” he wrote on one job site. “Come get our training, and become one of our brokers and make tons of cash in commission!!!!!!” One ad was accompanied by a photo of a room filled with stacks of banknotes.

When contacted by the Bureau Yedibaslar said he had worked for Express Target Marketing, not Inside Option, and insisted he was entirely innocent of any wrongdoing. “I have never not earned a straight dollar in my life!” he said.

CASE STUDY: Steve Taylor and Kim Innes

Lorry driver Steve Taylor, 59, lost the money he had been saving for his wedding to partner Kim Innes after betting it on binary options. “We’d been saving for the wedding and I was looking for a way to make a bit more money as well as topping up my pension,” he said. “Binary options sounded like a good idea. It wasn’t.”

Steve was enticed by a cold caller to trade with Inside Option: first £200, then £800.

He went on to open an account with another company, AA Option, and then got a call from a salesman there. “I gave him my debit card details but I told him I only wanted a very small amount taken out, as that was the account I paid my bills with,” Steve claimed.

That evening, he got an automated call from his bank – the Bank of Scotland – alerting him to suspicious activity on his account. Upon visiting his local branch the next morning he found out the account had been emptied of the £2,400 it contained.

Steve Taylor and Kim Innes

By Peter Jolly for the Daily Mail

Steve Taylor and Kim Innes

By Peter Jolly for the Daily Mail

The bank initially returned the money but once it established Steve had given AA Option his card details it took the money out again.

After that Steve decided to withdraw the money he had placed with Inside Option. It refused, saying that because he had a new bank card it could not be sure he was who he said he was, even after he had given the company clear proof.

But after losing most of his wedding fund to AA Option Steve and Kim were determined to retrieve the £1,000. “For months I did nothing but email Inside Option, thirteen or fourteen times a day,” said Kim. “I told them I was going to lawyers, BBC Watchdog, you name it. I let them know I wasn’t going away until I got that money back.”

After months of emailing, Inside Option eventually paid the £1,000, but the couple were still £2,400 down and they put off their wedding for another year.

However this binary options story – unlike most – does have a happy ending. After being contacted by the Bureau, Bank of Scotland said it would refund the couple with the full amount taken by AA Option.

The SpotOption platform

SpotOption is one of six major providers of binary option trading platforms, all of which are based in Israel. It claims to be the platform provider for some 200 binary option brands making up 65% of the worldwide market, with a combined trading volume of some $5 billion.

The company hosts the trading process “end to end”: from the front end user interface to account management and payments to the ultimate company owners. It charges brands like Inside Option a percentage commission on its turnover. One insider said the binary options company he worked for was charged about 12% on its turnover by SpotOption.

The founder and primary shareholder of SpotOption is an Israeli known as Pini Peter, whose full name is Pinchas Peterktzishvilly. He was convicted of money laundering in 2005 in connection with one of Israel’s largest ever financial crimes: the embezzlement of some 254 million shekels (£51 million) from Trade Bank, a commercial bank.

Peter was not involved in the embezzlement, but was convicted of forging signatures on cheques.

Responding to the Bureau’s investigation, SpotOption said Peter had “no role in the company other than as a shareholder.” It said its platform had been “certified for compliance with the regulatory requirements in the EU, Japan, Australia, the US and elsewhere”. Its user policy obliged brokerage firms using its services to “ensure their operations are in line with applicable law and regulatory requirements,” it added.

David Ripstein, the CEO of SpotOption Limited, told the Bureau: “I will reiterate SpotOption’s support for the regulated binary options industry and our strong desire to see all operations in this industry conducted in a lawful, regulated and fair manner.”

Lack of UK action

The Treasury carried out a consultation last year which considered whether binary options sellers should be regulated by the Financial Conduct Authority (FCA), but no conclusions were published and no legislative changes have been brought about.

If these companies were regulated by the FCA the regulator could warn investors against specific fraudsters – but many of the victims we spoke to say they want a complete ban on binary options firms selling to the general public.

The FCA issued a statement last July warning consumers about fraudulent binary options companies, highlighting the fact it had no power to take action. “We are particularly concerned about the experiences many consumers report to us when trying to deal with unauthorised or unlicensed binary options firms,” it said. “We regularly hear about such firms suddenly closing consumers’ trading accounts, refusing to pay back their funds and ceasing any further contact with the consumer…. Binary options are not currently regulated by the FCA so your investment is not protected.”

The Treasury declined to give a statement to the Bureau, saying only that it took the issue of binary options very seriously and the response to its consultation would be published “in due course.”

Not good enough, said one UK victim who lost more than £90,000 to Inside Option. “These companies need to be stopped,” he said. “They ruin people’s lives and somebody should be doing something about it.”